The market consolidated at the beginning of the week but it was finally able to resume its uptrend on Wednesday. Even if the US non-farm payrolls were very strong and if they increase the risk of a more hawkish Fed in coming months, the market decided to focus on the number itself rather than on possible medium term implications. This underlines a positive mindset from investors: they decided to see the glass half-full rather than half-empty.

Economy:

Economic data continue to surprise to the upside in both the USA and Europe. This is positive for sentiment and this should allow economists and strategists to uplift their expectations for the economy. This should have a positive effect on price performance.

Valuation:

Following year to date decline in the European equity market, the European valuation score improved from '3' (neutral) to '4' (attractive). It remains at this level this week.

In the USA, the valuation score remains at '2' (unattractive): US equity market is printing new all-time highs while earnings estimates have been cut in recent months. So, valuation is rather stretched on this market.

Sentiment:

Bull-bear spread remains close to zero, there is no sign of euphoria or panic in the equity market. On top of that, with a neutral sentiment above 40%, we consider that market sentiment is not really relevant at this time (too much uncertainty in the market).

Technical analysis:

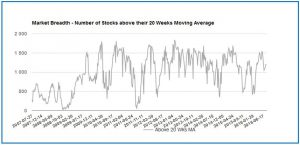

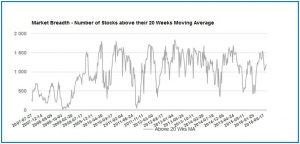

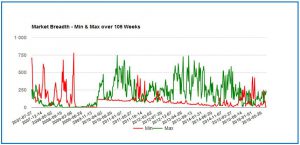

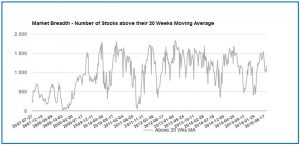

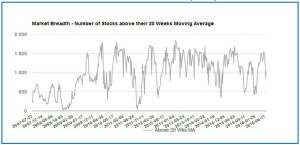

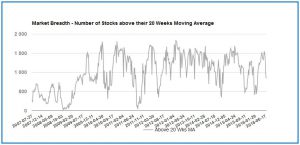

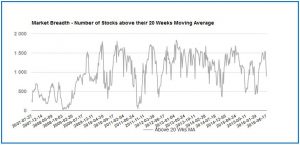

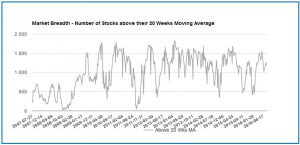

The number of companies trading above their 20weeks average slightly declined this week (grey curve). Even if it is difficult to draw any conclusion on this chart because current values are close to average historical levels, it is rather surprising that this metric deteriorated while the equity market looks so bullish.

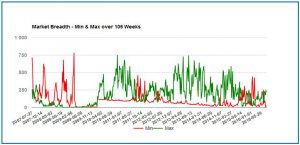

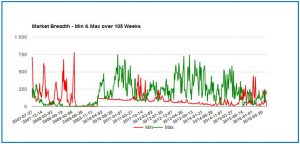

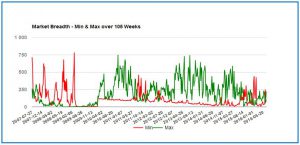

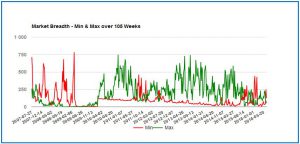

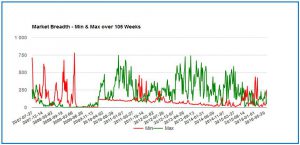

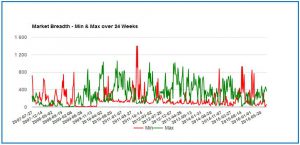

We can also notice on the second chart that the number of stocks printing new 6 months highs slightly decreased (green curve) while the number of stocks printing new 6 months lows slightly increased.

So, both charts are pointing in the same direction: even if the equity market seems highly bullish, its internal dynamic is currently deteriorating and this is a major warning we will have to monitor in coming weeks.

Following the post-Brexit rally in European equity market, the Sigma European technical score improved from '3' (neutral) to '4' (positive). It remains at this level this week.

In the USA, thanks to the strong performance of US equities, the Sigma US technical score has been unchanged at '4' (positive) for a couple of weeks.

Looking at the Sigma Whole Europe Index, we can notice this index sharply bounced back on a major horizontal support. On top of that, our intraday trend indicator (red curve on the second chart) reversed to the upside. So, it seems the short term positive scenario is the one to favor (on European equities) based on our indicators.

The Sigma Whole US Index resumed its uptrend and is, once again, printing new all-time highs. As we can clearly identify 5 sub-waves in current leg up started in late June, there is a meaningful probability that we are in the last phase of current rally. Looking at the chart of our intraday trend indicator (red curve on the second chart), we can notice this indicator also reversed in the USA. So, based on our indicators, the short term positive scenario is also the one to favor in the USA.

Conclusion:

It seems the consolidation is over. So, new all-time highs will probably be printed early next week in the USA while the European equity market should pursue its post Brexit rally. Nevertheless, with deterioration in internal market dynamic, stretched valuations in the US equity market, a nearly complete pattern in the wave structure and positive economic surprises, we fear the equity market is vulnerable to negative news. We keep our opinion that the equity market in both the USA and Europe will probably print a MAJOR TOP in the last 2 weeks of August.