Après une semaine particulièrement attentiste, les marchés d'actions ont finalement été soulagés vendredi par des chiffres d'emploi relativement "mitigés". Ceci éloigne donc considérablement le risque d'une hausse de taux en septembre et nous dirige donc vers une seule hausse de taux en 2016 (tout comme en 2015). A ce rythme là, il risque de falloir quelques années avant que la Fed ne normalise sa politique monétaire. Il est également important de noter que l'indicateur ISM Manufacturing a été publié en dessous des attentes du marché à 49.6 (càd en dessous de la barre des 50 signalant la frontière entre expansion et contraction d'activité).

Economie:

Le niveau des surprises économiques continue de se détériorer tant aux USA qu'en Europe. Les deux courbes sont désormais proches de zéro, ce qui signifie donc que les économistes et les stratégistes pourraient commencer à réduire leurs attentes économiques. Ceci devrait donc entrainer des révisions à la baisse sur les attentes bénéficiaires des sociétés, ce qui devrait à son tour peser sur le marché des actions US et Européennes.

Valorisation:

Le marché Européen a vu son score de valorisation s'améliorer en passant de '3' (neutre) à '4' (attractif) suite à la forte baisse des actions européennes en ce début d'année. Son score de valorisation reste inchangé cette semaine.

Aux USA, le score de valorisation reste à '2' (inattractif). Il est vrai que le marché américain réalise de nouveaux sommets historiques semaine après semaine alors que les attentes bénéficiaires ont été considérablement revues à la baisse ces derniers mois. Les niveaux de valorisation sont donc tendus sur ce marché.

Sentiment:

L'écart entre le sentiment 'bull' et le sentiment 'bear' est désormais légèrement négatif, mais il n'y a aucun signe de sentiment extrême à ce jour. De plus, avec un sentiment 'neutre' restant proche des 40%, nous ne pouvons pas considérer que l'écart entre les bulls et les bears soit actuellement relevant car il y a beaucoup trop d'investisseurs 'neutres/sans opinion'.

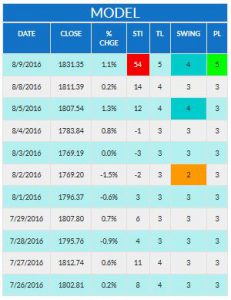

Analyse Technique:

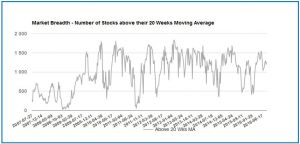

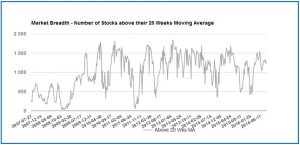

Le nombre de sociétés se traitant au-dessus de leur moyenne à 20 semaines (courbe grise) est relativement inchangé cette semaine. Bien qu'il soit difficile de tirer la moindre conclusion sur les niveaux actuels car la courbe se situe dans sa zone médiane et peut donc évoluer dans les deux sens (à la hausse ou à la baisse), la détérioration de cet indicateur ces dernières semaines montre tout de même une certaine forme de "fatigue" dans le marché.

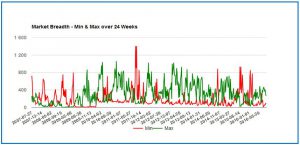

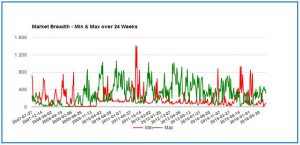

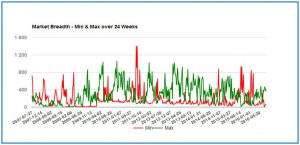

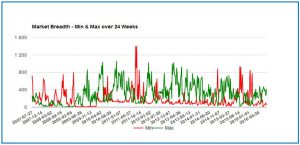

Nous pouvons constater sur le second graphique que le nombre de sociétés réalisant des nouveaux sommets à 6 mois (courbe verte) est en hausse cette semaine tandis que le nombre de sociétés réalisant des nouveaux plus bas à 6 mois (courbe rouge) est en baisse. Ceci montre donc une amélioration importante de la dynamique interne du marché

Sur base de ces deux graphiques, nous pouvons donc considérer que la dynamique interne des marchés s'est améliorée ces derniers jours. Ceci constitue donc un élément positif important sur le plan technique.

Suite au fort rebond des actions européennes depuis fin juin, le score technique du Sigma Whole Europe Index s'est amélioré en passant de '3' neutre à '4' attractif. Il reste à ce niveau cette semaine.

Aux USA, la situation technique reste inchangée grâce à la bonne performance des indices, le score technique est à '4' (attractif).

Lorsque l'on analyse le Sigma Whole Europe Index, l'on constate que l'indice a fortement progressé en fin de semaine et semble casser une résistance horizontale importante. Si cette cassure est confirmée la semaine prochaine, le marché pourrait bien aller retester la résistance horizontale rose dans les prochaines semaines.

Avec deux retournements positifs mercredi et jeudi, le Sigma Whole US Index montre, une fois de plus, qu'il ne veut pas baisser. De plus, avec la diminution du risque de hausse des taux à court terme suite aux chiffres mitigés de l'emploi américain, le marché américain semble avoir une raison de plus pour rester bien orienté. A ce stade, le trading range reste étroit, mais l'on devrait vrais semblablement assister à une cassure de ce range dès la semaine prochaine.

Conclusion:

Avec les surprises économiques qui se sont fortement détériorées ces dernières semaines et avec des statistiques majeures (ISM et payrolls) qui ont déçu la semaine dernière, la Fed a désormais une "bonne raison/excuse" pour ne pas augmenter ses taux en septembre. Il devient donc de plus en plus difficile d'envisager un catalyst baissier à court terme sur le marché.